Business Insurance in and around Everett

One of Everett’s top choices for small business insurance.

This small business insurance is not risky

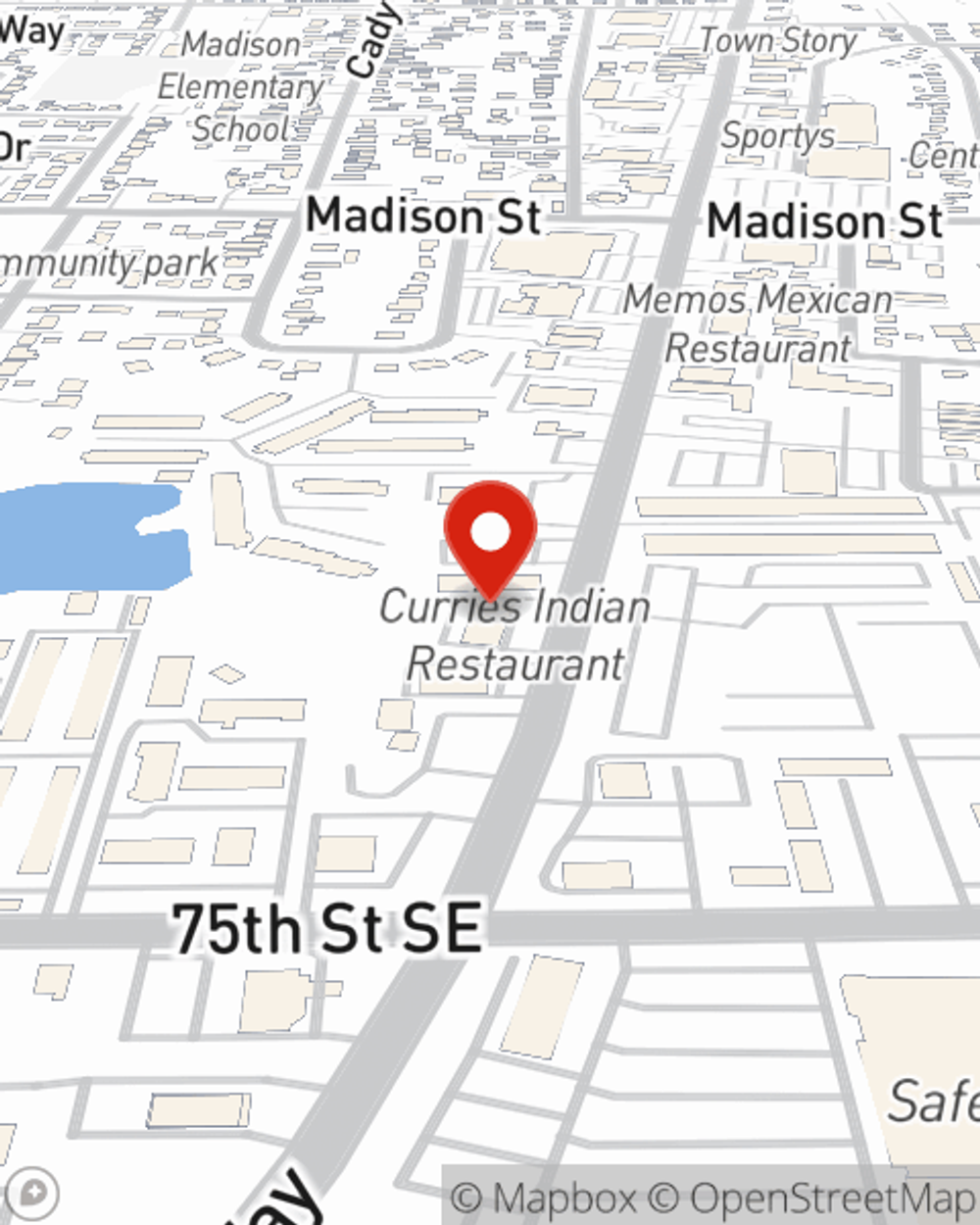

- Everett

- Marysville

- Lynnwood

- Snohomish

- Arlington

- Mill Creek

- Bothell

- Mukilteo

- Lake Stevens

- Edmonds

- Mountlake Terrace

- Monroe

- Esperance

- Martha Lake

- North Creek

- Alderwood Manor

- West Lake Stevens

Your Search For Fantastic Small Business Insurance Ends Now.

Running a small business comes with a unique set of challenges. You shouldn't have to wrestle with those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, business continuity plans and errors and omissions liability, among others.

One of Everett’s top choices for small business insurance.

This small business insurance is not risky

Cover Your Business Assets

Whether you own a clock shop, an ice cream shop or a beauty salon, State Farm is here to help. Aside from outstanding service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Agent Monte Cain is here to explore your business insurance options with you. Reach out Monte Cain today!

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Monte Cain

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.